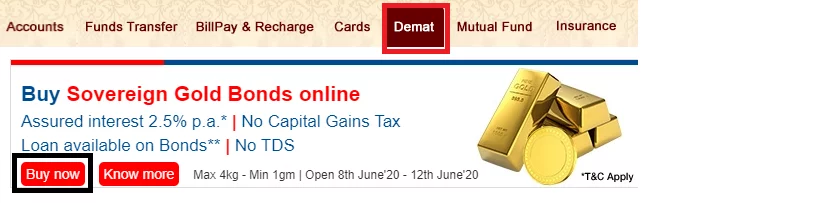

HDFC Bank - Govt. issued Sovereign Gold Bond with assured interest of 2.5% p.a. Hurry! Offer valid 24th Oct - 2nd Nov, 2016. Know more: http://bit.ly/HDFC_Goldbond | Facebook

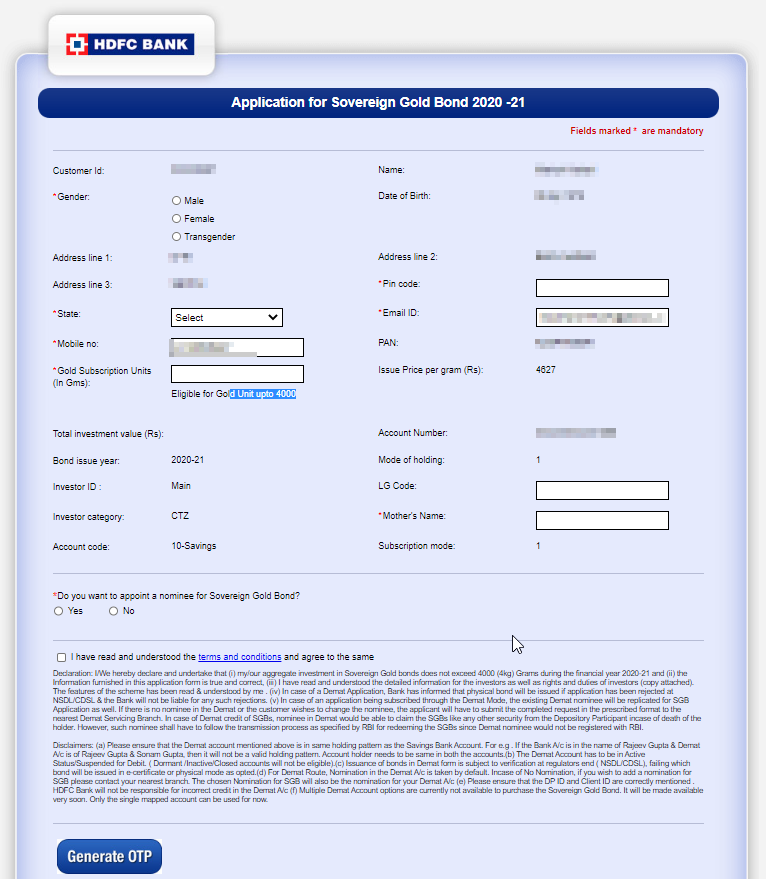

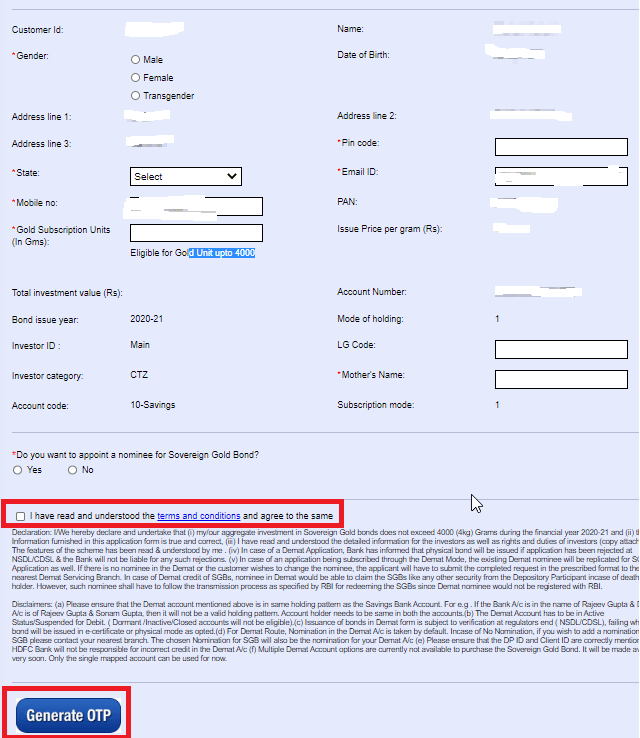

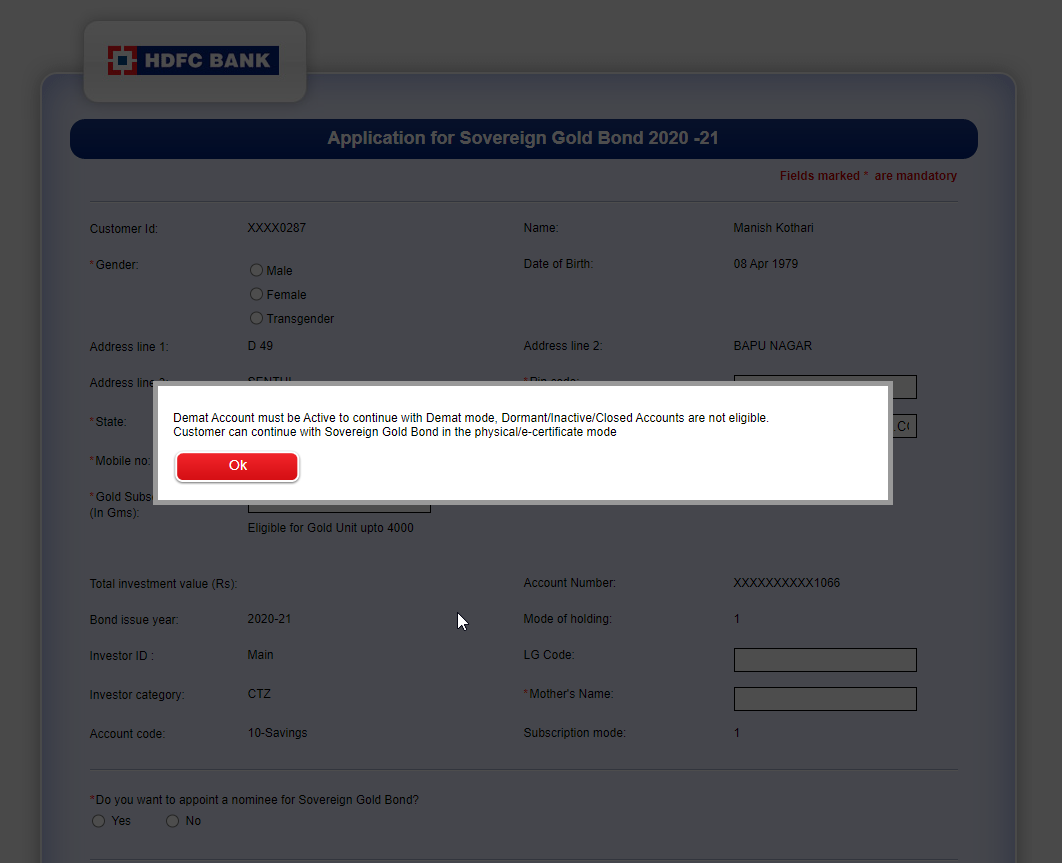

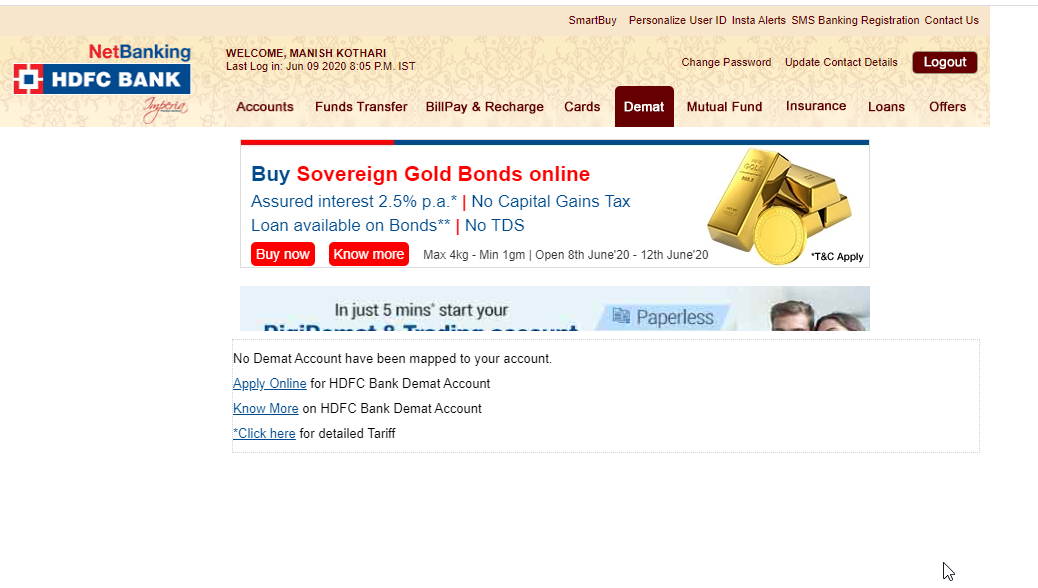

HDFC Bank Sovereign Gold Bonds Online | Planning to invest in gold? Do it online with Sovereign Gold Bonds and get amazing benefits! For more information: - Login to HDFC Bank NetBanking,...

HDFC Bank - Invest your money the smart way! Purchase Sovereign Gold Bonds for an assured interest of 2.5% p.a.* Offer opens: 13th November 2017. Offer closes: 15th November 2017. Know more:

HDFC Bank on Twitter: "Invest your money the smart way! Buy Sovereign Gold Bonds for an assured interest of 2.5% p.a.* Offer closes 15 Nov https://t.co/FMHPXlhs47 T&C apply https://t.co/QbmGVjL8Zo" / Twitter

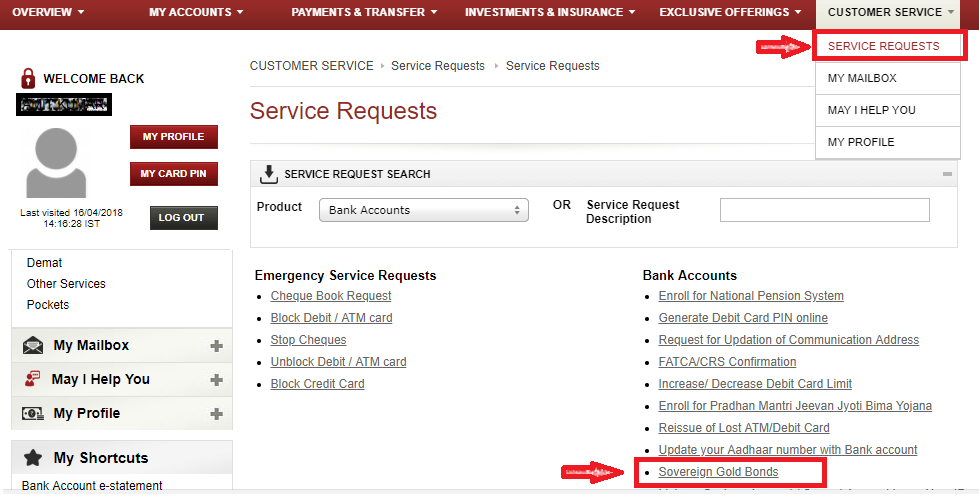

How To Buy Sovereign Gold Bonds? Invest With Few Clicks On SBI, ICICI, Etc ☆ ApnaPlan.com – Personal Finance Investment Ideas

HDFC Bank - Govt. issued Sovereign Gold Bond with assured interest of 2.5%. Hurry! Issue open from 10th July- 14th July 2017 only. To apply visit http://bit.ly/HDFC_GOLDBOND. | Facebook

HDFC Bank on Twitter: "Govt. issued Sovereign Gold Bond with assured interest of 2.5%. Valid from 27th Feb - 3rd March 2017. Apply Now! https://t.co/HC64J0R62X https://t.co/vwVHPKaIL5" / Twitter

HDFC Bank on Twitter: "Celebrate this festive season by investing in Sovereign Gold bonds. Get an assured 2.5% p.a. interest with No Capital Gains Tax! To invest, login to NetBanking > Click

Why I am unable to buy SGB in Zerodha - Zerodha - Trading Q&A by Zerodha - All your queries on trading and markets answered

HDFC Bank - With your HDFC Bank's NetBanking or Demat Account, invest in Sovereign Gold Bonds online and earn an assured 2.5% interest*. To know more: http://bit.ly/GoldBond_HDFCBank | Facebook

HDFC Bank on Twitter: "Govt. Issue Sovereign Gold bonds with 2.75% interest valid from 1st Sept-9th Sept. Apply Now https://t.co/qW5ZDn7kox https://t.co/uxpHpAJDnk" / Twitter